|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

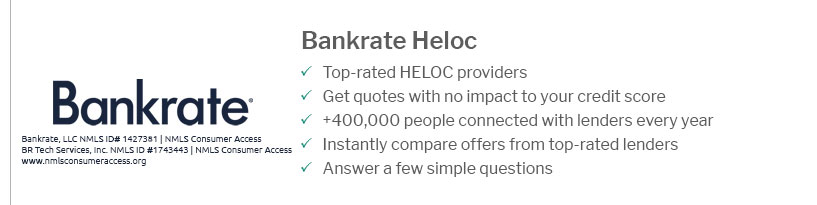

How to Apply for a HELOC: A Comprehensive GuideApplying for a Home Equity Line of Credit (HELOC) can be a strategic financial move for many homeowners. A HELOC allows you to borrow against the equity in your home, providing a flexible line of credit that you can use for various purposes. Understanding HELOCsA Home Equity Line of Credit is a revolving credit line secured by your home. It often comes with variable interest rates and a draw period followed by a repayment period. Key Benefits of HELOCs

Steps to Apply for a HELOCEvaluate Your Financial SituationBefore applying, assess your financial health. Ensure you have a stable income and a good credit score. Research and Compare LendersNot all lenders offer the same terms. Compare interest rates, fees, and repayment options. For example, explore jumbo interest rates if you are considering a larger loan amount. Prepare Necessary Documentation

Submit Your ApplicationOnce you've chosen a lender, complete their application process. This may include an appraisal of your home and a credit check. Common Uses for HELOCsHELOCs are versatile financial tools. Some common uses include:

For those looking to refinance, consider learning about no fee refinance mortgage rates to potentially save on costs. FAQs About HELOCsWhat is the difference between a HELOC and a home equity loan?A HELOC is a revolving line of credit, whereas a home equity loan provides a lump sum with fixed interest rates. Can I pay off my HELOC early?Yes, you can usually pay off your HELOC early, but check for any prepayment penalties. How does the draw period work?The draw period is the time during which you can borrow money from your HELOC, typically 5-10 years. Understanding these aspects can help you make informed decisions about applying for a HELOC and utilizing it effectively. https://www.navyfederal.org/loans-cards/equity/resources/how-to-apply.html

How to Apply for a Home Equity Loan or Line of Credit (HELOC) - Step 1. Understand Your Timeline - Step 2. Choose a Loan Type - Step 3. Gather Your Information. https://www.sofi.com/home-loans/heloc/

To receive the $1,000 offer you must: (1) Apply for a SoFi originated home equity loan through the promotional 'View Your Rate' link in this ad. You must not ... https://www.truist.com/loans/heloc

Here's what you'll need to provide for your application: Personal information (name, home address, phone number, and Social Security number); Co-applicant's ...

|

|---|